Dear Colleague,

TFL PENSION FUND - INDEPENDENT REVIEW

I refer to my previous correspondence, 2Oth December 2021, you will be aware that Sir Brendan Barber the head of the Review Commission looking into the TfL Pension Fund submitted the final report on 28th March 2022.

While many of the report's findings and recommendations will not come as much of a surprise the stand-out feature of the review is its retreat in terms of timing. The terms of reference of the report set out that: by 31 March 2022, “having considered all of the evidence and representations received, the Independent Lead shall provide a Final Report, setting out a full analysis of the Options and a recommended approach along with an implementation plan.”

Instead of a recommended approach and implementation plan we have an assortment of attacks on the pension and a list of reasons why potential changes will take years to implement.

It needs to be said that our live ballot and the fact that our members have shown they will fight in defence of their deferred pay, has pushed TfL back at this stage. Make no mistake that without the threat of massive strike action TfL would be pushing forwards at a far greater pace although we expect that management with Government support will try to implement some form of detrimental changes in 2023.

The report also confirms that the fund is in surplus but argues that the employer's contributions will have to be 5 times the rate of members' contributions as they estimate a real rate of return on investments at 1.5%.

However, like the presentations to the contact group, the report also threatens significant detrimental changes to the pension in the order of a 30% reduction in benefits for future accruals.

The report writes favourably of moving to a CARE scheme but also highlights the difficulties of implementing such change, which would entail one possible option of closing the existing scheme and opening a new one for new employees. However, the report states without pulling any punches that a move to some form of CARE arrangement would save TfL millions of pounds but at the expense of members retirement income:

“The modelling for CARE schemes (including those with tiered contributions) shows cost reductions for TfL of up to £154.4m a year to a cost increase of £23.1m a year. Almost all of the benefit combination scenarios see reductions in the future service benefits available to members, and increased contributions compared to the current position. However, these benefit reductions or contribution increases are not felt evenly by members”

Unlike the TfL “Final Salary” Pension Fund which bases your pension at retirement on your last years pensionable salary, normally the highest amount of salary, a CARE pension scheme bases your pension benefits on the average of all your salaries throughout your pension scheme membership. While each year of your CARE pensionable salary is revalued, because your benefits are calculated on an average of your total pensionable pay, rather than your last year, it is unlikely that any form of CARE will deliver higher benefits than a Final Salary arrangement.

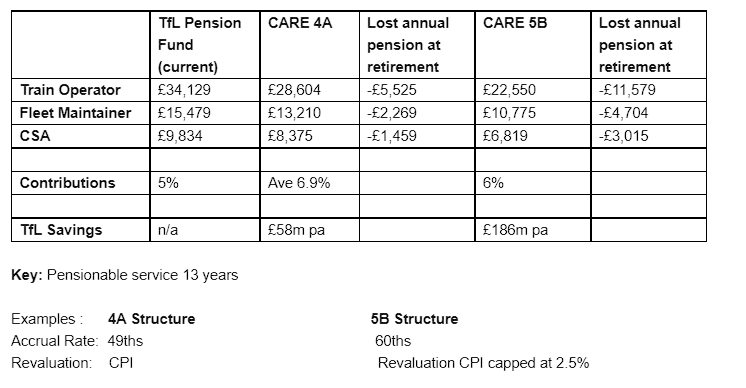

The effect on member's benefits at retirement, as well as during retirement, are illustrated in Appendix 4 of the final report where a number of potential pension structures are modelled. We have chosen just two of the CARE structures (4A and 5B) to demonstrate the level of pension members in three LUL occupations could expect to receive at age 60 if these proposals were implemented when compared to the current TfL Pension Fund.

As you can see from these examples members benefits are significantly reduced at the expense of the savings TfL can expect to make on an annual basis.

Simply if any of these proposals were implemented members can expect to pay more, receive less and ultimately work longer to receive the same level of pension they would currently receive in the TfL Pension Fund.

The report is so unfocused in terms of an actual proposal that it is difficult to make any more detailed comment than we already have but there are a few additional points of interest.

1800 of fund members are “protected” from any detrimental change to the pension arrangements by virtue of agreement made when they transferred to either Tubelines or Metronet. We should use the demand that we all deserve to be protected.

Although the report states that past accruals must be safeguarded it is possible that members could lose out on their accrued pension benefits if TfL opted to treat accrued benefits on a left service basis. That is to say that past accruals are treated as deferred benefits which can only be indexed up to a maximum of 5% (unless date entered service is pre 1989) and in any event, by RPI. If wages rise faster than RPI in the future post 89 members would lose out. Additionally, I believe that if the left service approach is taken to past accruals then anyone who gets a promotion after the date of change would not have their past accruals applied to their new final salary. (This last point needs checking).

In terms of implementation the report confirms that implementing changes to the terms of the current fund would require either agreement from members, for which there is no process at this time, or primary legislation. However, the rate of members contributions can be varied by agreement between the trustees and the primary employer, TfL.

This opens the possibility of the employer demanding massive contribution increases unless we agree to changes in benefits paid.

In summary:

- The report has stepped back from its terms of reference and has not made a recommendation for attacking the fund and has not made any proposals for implantation.

- This is because of our opposition and members demonstrating they are prepared to fight for their pension and against cuts.

- But massive threats remain on the table - of a loss of benefits of around 30% for someone who retires at 60. These threats must be taken off the table.

- The main finding of the report is that it is going to be very difficult for TfL to attack our pension.

- The report is about buying time but not safeguarding the pension in the long run. Unless TfL is properly funded there will be a financial imperative for TfL management to reduce their pension contributions.

We must continue to fight for funding and for our demands of No cuts, no job losses, no detriment to our pension.

I will keep you informed of developments.

Yours sincerely,

Michael Lynch

General Secretary

- 2211 reads